Modern technology has long since invaded our daily lives, transforming them at an unprecedented pace. It’s hard to imagine everyday life without it. The catalyst for technology’s widespread adoption was Apple’s introduction of fingerprint recognition, which forever changed the familiar process of paying for goods and services

In 2013, Apple introduced TouchID, demonstrating to the world how biometrics could simplify and accelerate everyday interactions. Within just a few years, facial recognition, fingerprint scanning, and other biometric solutions were actively integrated by stores and banks worldwide. For instance, in China, Tencent created a palm vein recognition payment system. Similarly, in Russia, biometric payment solutions emerged, allowing users to authorize transactions using face or voice recognition via the Unified Biometric System (UBS) and SBPay, a dedicated payment application.

Just 7–8 years ago, we quietly crossed a threshold when retailers began actively adopting facial recognition, rapidly turning retail into the fastest-growing sector for this technology. Today, biometric payments provide users with increasingly convenient and secure transaction confirmation methods.

So, what exactly is biometric payment? It’s an innovative technology that enables financial transactions—such as payments or cash withdrawals—by identifying users through unique physical or behavioral characteristics. Unlike traditional methods involving cards, smartphones, or cash, biometric payments rely on fingerprints, facial recognition, palm vein patterns, or other personal biometric data to securely verify identity and authorize transactions.

Biometric payment is one of the most striking examples of how innovation is transforming familiar payment processes into something more convenient and futuristic. But how does this technology work, what are its advantages, and what prospects does it open up?

The Development of Biometric Payment Technology in Russia

Biometric payment in Russia began to develop relatively recently, against the backdrop of the growing popularity of biometric technologies and the need for more convenient and secure payment methods. As the technology developed, it incorporated the implementation of biometric systems for authenticating users in financial operations, such as paying for goods and services, withdrawing cash, and accessing banking services.

The beginning of the use of biometrics in Russia is considered to be 2016–2017, when major Russian banks began to introduce biometric technologies for identifying customers in their branches. In fact, this was also the time of the first integration into payments: biometrics was primarily used to confirm operations, for example, through a fingerprint at ATMs.

The development of biometric payment was also accompanied by the creation of a key infrastructure and legal framework, which became the foundation for the implementation of biometric payments.

The main stages of the development of biometric payment in Russia begin with the emergence of biometrics in the banking sector. During this period, major Russian banks, such as Sberbank, began to introduce biometric technologies for identifying customers in their branches. Biometrics was primarily used to confirm operations, for example, through a fingerprint at ATMs.

In 2018, the Unified Biometric System (UBS), developed by Rostelecom and the Bank of Russia, was launched. The system allows banks and organizations to use biometric data (face and voice) for remote identification of customers. The UBS became the basis for the further development of biometric payment, as it combined the biometric data of citizens into a single database. Major banks began to use this system to provide remote services, including opening accounts and lending.

In 2021, Sberbank launched a face-pay system in a number of cafes, restaurants, and supermarkets. The technology was based on the use of cameras that scan the customer’s face, comparing it with biometric data registered in the system. At the same time, biometric payment for travel began to be implemented in the Moscow metro as part of the Face Pay project. This allowed passengers to pass through turnstiles without using a card or phone.

With the development of technology, biometric payment spread beyond Moscow, starting to operate in the regions. Retail chains, such as "Perekrestok" and "Pyaterochka", began testing payment-by-biometrics systems. ATMs began to support biometric identification for withdrawing cash, depositing money, and other operations. The authorities continued to promote the use of UBS, and also developed regulations to protect biometric data.

At the heart of the Russian biometric payment technology is the interaction of UBS (Unified Biometric System) and the SBPay module, which makes it versatile and accessible to a wide audience.

A key element of biometric payment is the integration with the UBS and SBPay platforms:

- UBS performs the secure storage and processing of biometric data, ensuring its verification in real time.

- SBPay allows you to link a bank account to the service and manage payments. All this is available right in the mobile application today

How Does Biometric Payment Work?

Making purchases using biometric data through the Faster Payment System (SBP) is also becoming increasingly popular in Russia. This method provides convenience and security when making transactions. Below is a simplified instruction on how to connect and use biometric payment through SBP (Faster Payment System).

Stage 1: Registration and Connection

To start using the service, the user must:

- Register their biometric data (face or voice) in the UBS through a partner bank (remote banking services).

- Connect the “Payment by Biometrics” service in the SBPay application, specifying the bank account for withdrawals.

- Provide consent to the processing and transfer of data.

Stage 2: Payment

When making a purchase:

- A POS terminal with biometric support reads the user’s face or voice.

- The read data is sent to the UBS for verification.

- After successful identification, the transaction is initiated through the SBPay module, and money is debited from the specified account

This architecture minimizes transaction execution time and simplifies the payment process for users.

Case Study: Implementing Biometric Payments at VTB Bank

MST implemented the payment part of biometric payment for VTB Bank to demonstrate the technology at the Finopolis 2024 exhibition and in pilot retail locations.

Benefits of Biometric Payment

Universality and Availability

Security

Speed

Simplicity for Business

Technological Implementation

Systems based on the EMV core are easily adapted to biometric payment due to their modular architecture. For example, the Lua scripting language, used to configure transactions, allows for the quick integration of biometric data processing and interaction with SBPay.

Terminals that support biometric authentication connect to UBS and SBP (Fast Payment System) via API, which reduces the complexity of implementation and accelerates deployment.

Future Prospects for the Technology

Biometric payment opens up new opportunities for both businesses and customers:

- For retail locations, it’s a way to attract an audience that values innovation and security.

- For banks and payment systems – a tool to increase loyalty and revenue.

Integration with the UBS and SBP platforms makes biometric payment a promising technology that is already changing familiar payment processes. It is expected that the implementation of biometric solutions will become the standard in the coming years, especially given their convenience and high level of data protection.

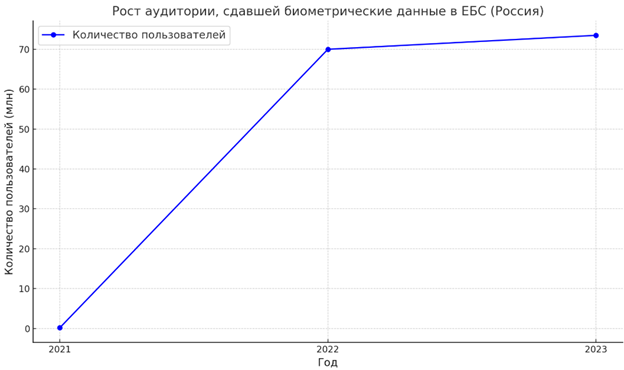

It is still difficult to assess the official statistics on the growth of the audience that has provided biometric data to the Unified Biometric System (UBS), since the technology has appeared on the financial services market relatively recently, and the daily growth rate of the user base is still known only in the form of statements by the UBS operator itself, which are estimated at approximately +3 thousand people.

However, it is possible to get an approximate cut based on public statements by key participants. By December 2022, the head of the Ministry of Digital Affairs reported that about 70 million Russians had provided their biometric data, mainly through banks. In March 2023, Rosstat recorded 73.5 million registered users in the UBS, including data transferred from banks. By September 30, 2023, the process of transferring biometric data from commercial systems to the UBS was completed, which contributed to an increase in the number of registered users.

Growth of the audience that has provided biometric data to the UBS (Russia). Number of users (millions)

At the same time, Russia is seeing growth in the use of biometric technologies for paying for goods and services. As of July 2024, Russians made 5.2 million payments using biometrics, which is more than 1.5 times higher than the figures for the previous year. In December 2024, it was reported that there are about 1 million terminals in the country that support payment by biometrics, and it is planned to double their number by the end of 2025. In the Moscow metro, 320 thousand users are registered who have made 82 million biometric passes. These data indicate a gradual increase in the number of transactions using biometrics in Russia, although the technology is still at the stage of active implementation and dissemination.

Why Businesses Should Implement Biometric Payment

Biometric payment in Russia has come a long way from creating a basic infrastructure to actively implementing innovative technologies. Systems such as UBS, Mir, and SBP have laid the foundation for the mass use of biometrics, and modern solutions have ensured its practical application in everyday life.

The technology benefits businesses for several reasons. First, it saves time: transactions take place in seconds, which reduces queues and increases the speed of service. Second, the introduction of innovations always attracts attention, especially among young people, which helps to expand the customer base. Third, the use of biometrics significantly reduces the risks of fraud, as biometric data is difficult to forge, and its transfer is carried out through secure channels. In addition, for small businesses, the SBP and biometric systems offer flexible solutions, eliminating the need for expensive cash registers and additional equipment costs.

Key trends in payment acquiring in Russia include system availability for small businesses and the self-employed, government support through subsidies and programs for small businesses, the development of the national payment infrastructure (including Mir cards and SBP), the improvement of technologies to reduce commissions and equipment costs, the introduction of analytical services based on acquiring and an increase in the share of non-cash payments, which by 2024 exceeded 70%, making non-cash payments faster, safer and more accessible.