Client

PJSC VTB Bank

VTB Bank (PJSC) is a Russian universal commercial bank with state participation.

Task

In April 2024, VTB Bank approached us with a request to conduct a pilot project for biometric acquiring and to showcase a ready solution at the Finopolis exhibition in Sochi.

In this case, biometric acquiring referred to the use of facial recognition to complete a payment. While this concept is not entirely new, the innovation lies in the details.

As is known, in 2024, a new platform for accepting biometric payments emerged in the Russian market, thanks to a partnership between the National Payment Card System (NSPK) and the Center for Biometric Technologies (CBT). The platform’s uniqueness lies in the fact that any bank customer can make purchases through any biometric acquiring provider connected to the platform. In other words, the platform serves as a bridge between the various biometric acquiring infrastructures of different banks. In this concept, biometrics are combined with the Faster Payments System (FPS).

A person who has submitted biometric data through the State Services portal can link their bank account to the SBPay app and use it as a payment tool for biometric payments.

To showcase the solution at the Finopolis exhibition, two stands were required.

- For VTB’s stand, we needed a coffee machine connected to a pin pad that allowed payments via biometrics, bank cards, and FPS.

- For NSPK’s stand, an autonomous terminal was required, capable of accepting payments via biometrics, bank cards, and FPS.

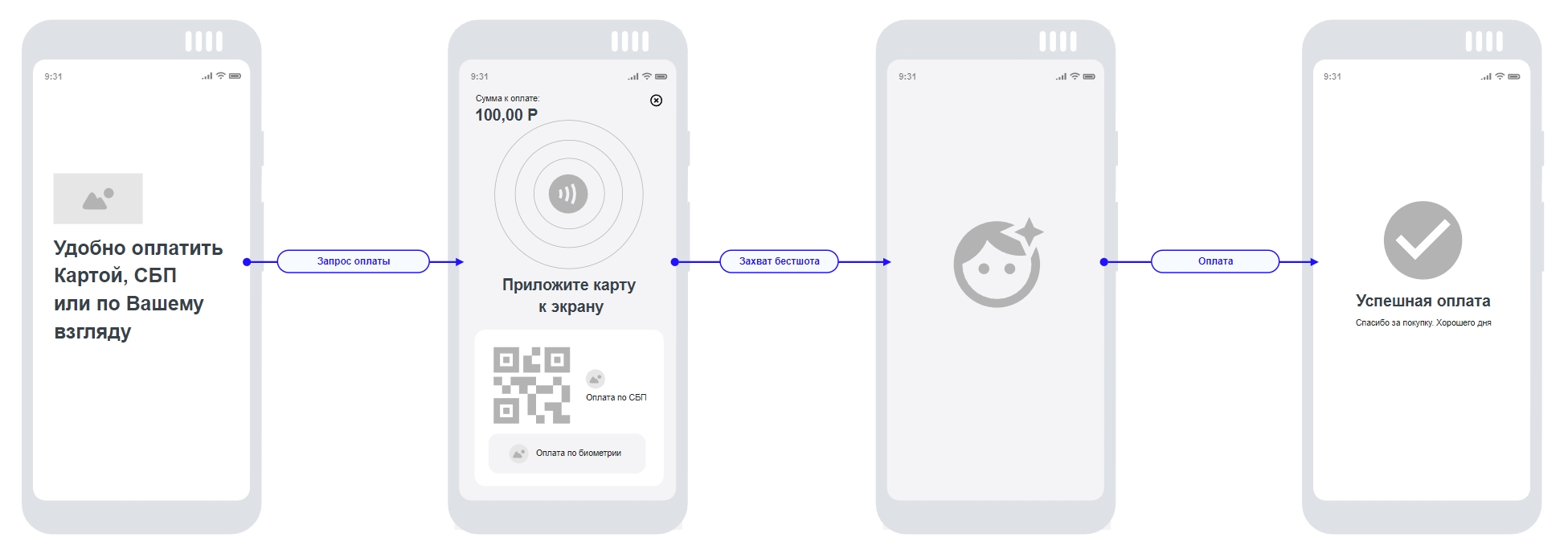

Scheme

At the start of the project, several participants were already involved, each responsible for a specific segment. However, a unified interaction scheme was still missing. Therefore, the first step in the project was to create a comprehensive interaction plan for all participants, as well as to map out the entire payment process—from capturing the payer’s face (best shot) to successful payment completion.

At the time the project began, VTB Bank had already implemented a Commercial Biometric System (CBS), which interacted with the Unified Biometric System (UBS) to collect customers’ biometric data. Therefore, a mechanism (service) was needed to manage communication between the end device (terminal), the CBS, and NSPK. It was crucial to minimize interference with the bank’s existing infrastructure. After several rounds of internal discussions, we developed a proxy service to handle communication with the bank’s CBS and NSPK for biometric payments—called MST BIO Proxy.

This service was installed within the bank's infrastructure and received best shots sent from the terminal. The BIO Proxy service then communicated with the bank’s CBS to identify the customer making the payment and to confirm the biometric data's verification level. After successful identification, BIO Proxy contacted NSPK to retrieve the payment tool. Once the payment tool was received, the service initiated the payment through FPS.

Implementing MST BIO Proxy saved considerable time on the project and provided a convenient tool for introducing biometric acquiring.

Equipment

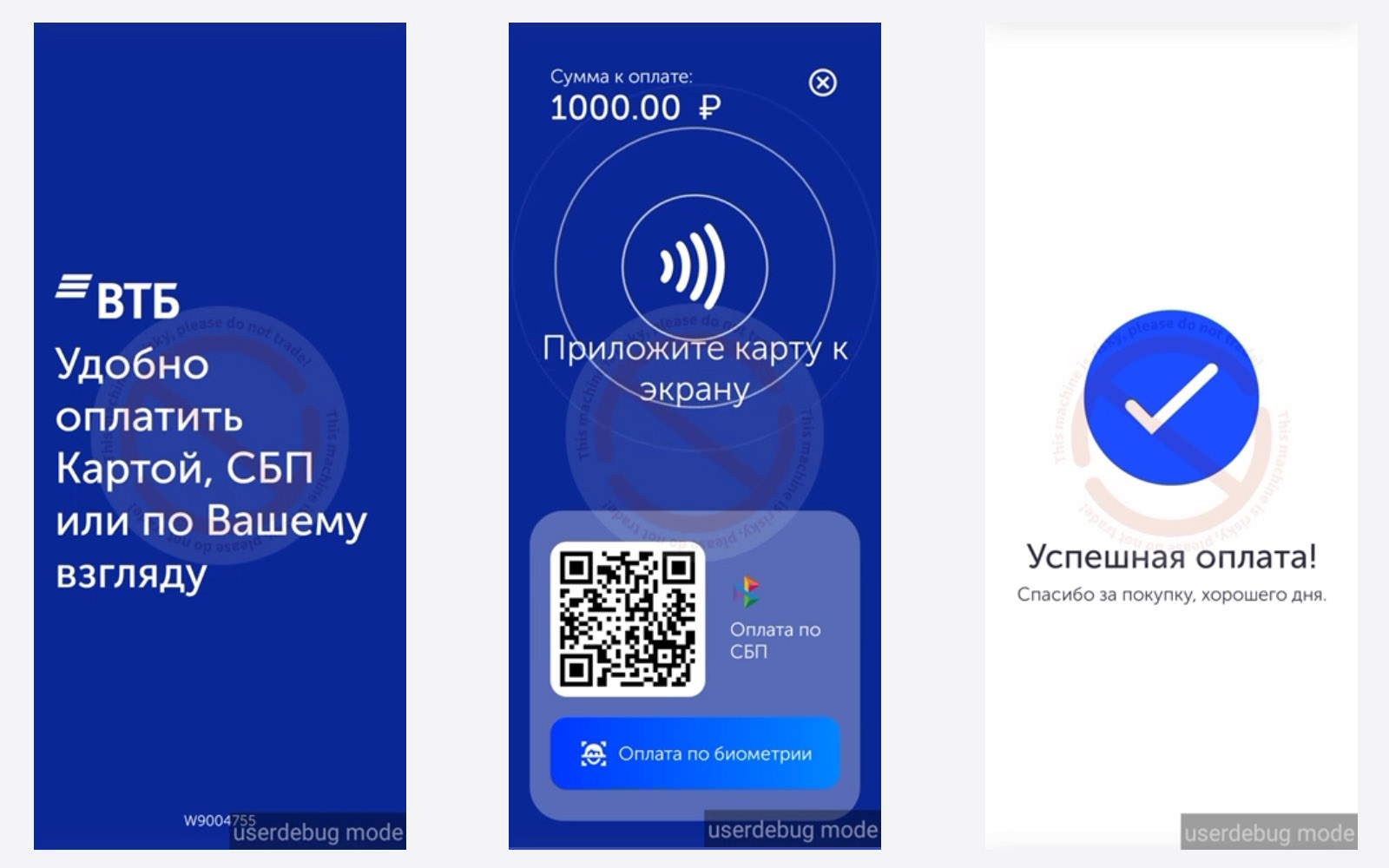

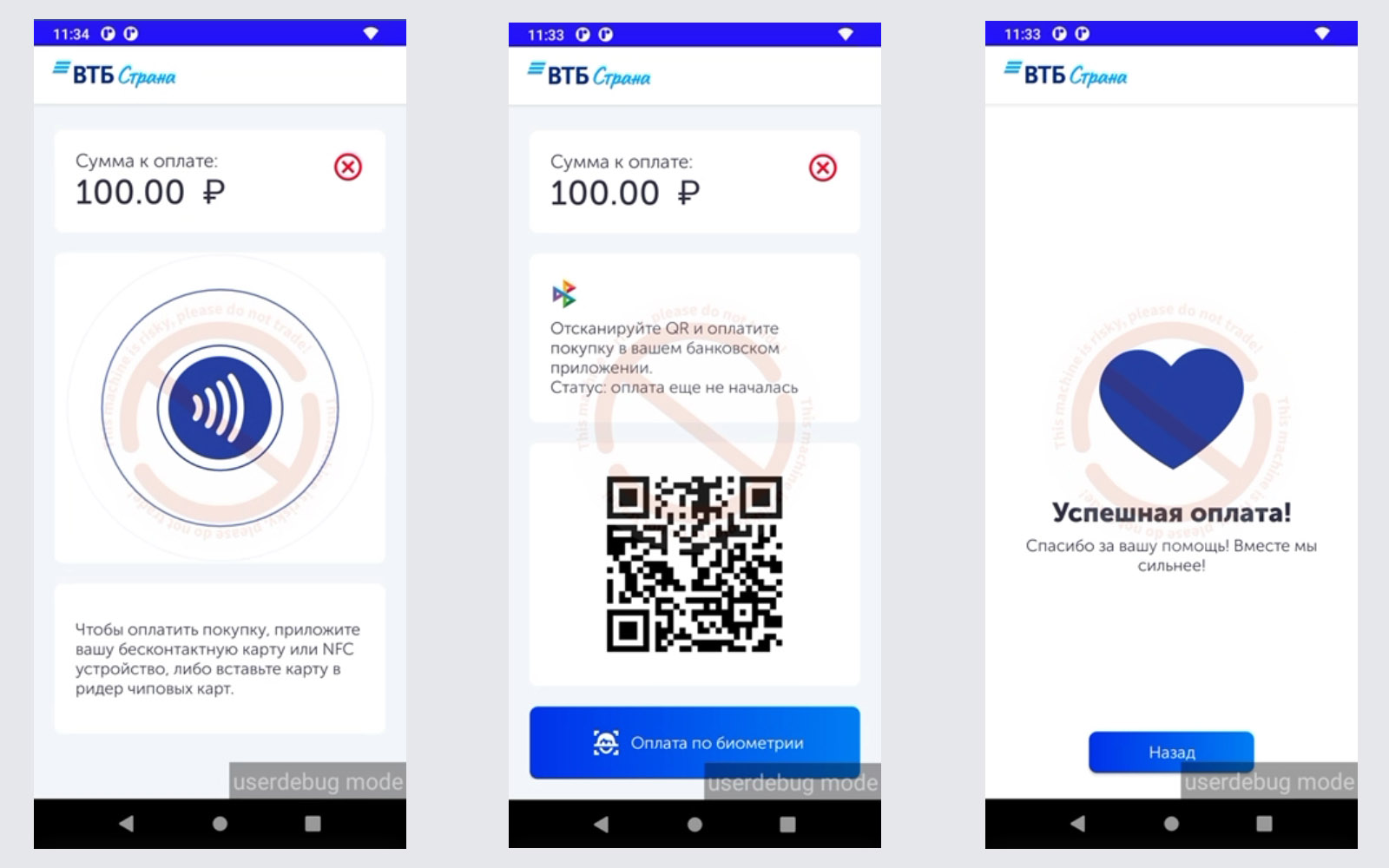

The Kozen P10f terminal running on the Android operating system was selected as the end device. This modern terminal features a large touchscreen and a front camera for capturing the customer’s face. Our JoinPOS application was used as the software on the terminal. JoinPOS can adjust its functionality based on settings, so for the NSPK stand, the Kozen P10f acted as an autonomous POS terminal, while at the VTB stand, it functioned as a pin pad connected to a coffee machine. Each option had its own interface and provided a different customer journey.

While the autonomous terminal setup was straightforward, the pin pad depended on the coffee machine. To ensure the devices could communicate and understand each other, we used our proprietary JoinPROTO protocol. Direct communication took place through a special MDB converter, which was compatible with our protocol. When a payment request was made on the coffee machine, the Kozen P10f pin pad was activated.

In addition to biometric payments, the terminal also needed to accept payments via bank cards and FPS. So, alongside the main tasks, we decided to pilot the device in a café located in the VTB Eurasia Tower.

Field testing revealed that customers did not always know where to tap their card. As a result, we redesigned the application interface, adding a visual cue to intuitively guide the customer to the correct spot on the screen for tapping their card.

Subsequent testing showed that the issue was resolved. The updated interface was rolled out not only on the pin pad but also on the autonomous POS terminal.

Exhibition

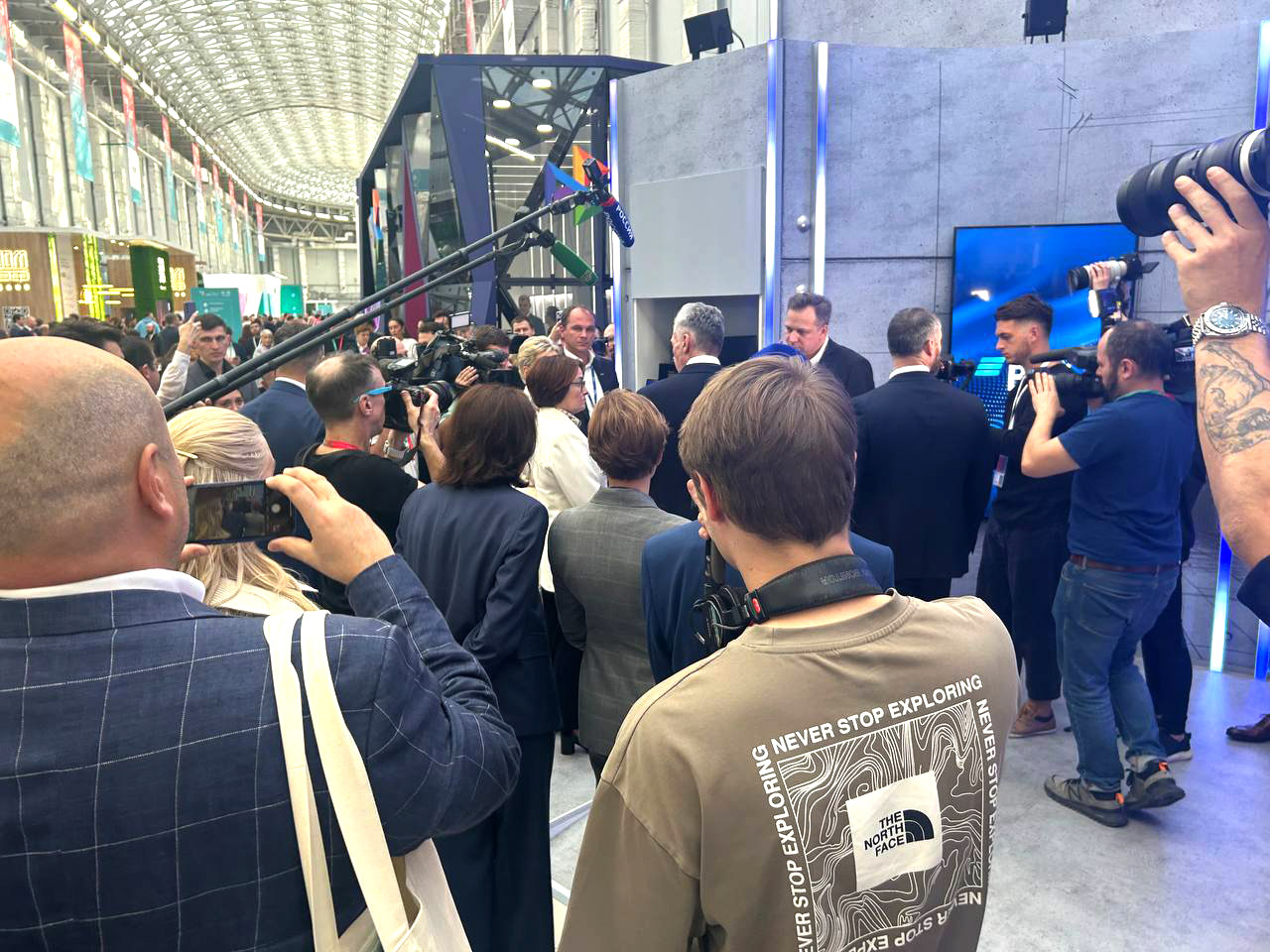

Finopolis is one of the largest exhibitions in Russia dedicated to payment technologies and emerging trends. Each year, major players in the financial sector present their latest innovations here. Over the course of the three-day event, more than 4,000 attendees, including heads of departments and industry leaders, visited the exhibition.

From day one of the Finopolis exhibition, the VTB stand showcasing biometric acquiring attracted significant interest from visitors. For example, the biometric acquiring solution at VTB's stand received high praise from the delegation of the Central Bank, led by Chairwoman Elvira Nabiullina. Additionally, demonstrations were conducted for the heads of the central banks of Armenia and Azerbaijan, who also recognized the potential of the solution.

At NSPK’s stand, the Kozen P10f with JoinPOS software was used as an autonomous terminal for collecting donations for the VTB Strana charity fund. The terminal was placed alongside other banks’ solutions. Visitors to the NSPK stand could compare the performance of various terminals and try biometric payments firsthand.

Conclusion

Without a doubt, piloting biometric acquiring was a challenging, exciting, and, in many ways, inspiring project for us. It laid the foundation for a new product—MST BIO Proxy, which allows banks to implement biometric acquiring services in a short timeframe. We will undoubtedly continue to develop this area and are ready to offer our solution for piloting to interested clients.

Отзыв заказчика

Хочется также отметить, что высокая эффективность обеспечивается в том числе и за счет хорошо проработанной архитектуры решения JoinPay, что позволяет нам быть уверенными в его высоком потенциале и способности удовлетворить будущие потребности Банка. Хотим поблагодарить руководство ООО «МСТ Компани» и всю команду за высокий профессионализм, клиентоориентированность и плодотворные партнерские отношения.