The system analyzes based on a set of predefined rules and delivers a verdict on whether a particular transaction can be trusted. It can also indicate reasons for potential rejection.

The anti-fraud service is designed in such a way that a qualified anti-fraud analyst can modify transaction evaluation rules to adapt the system to evolving requirements.

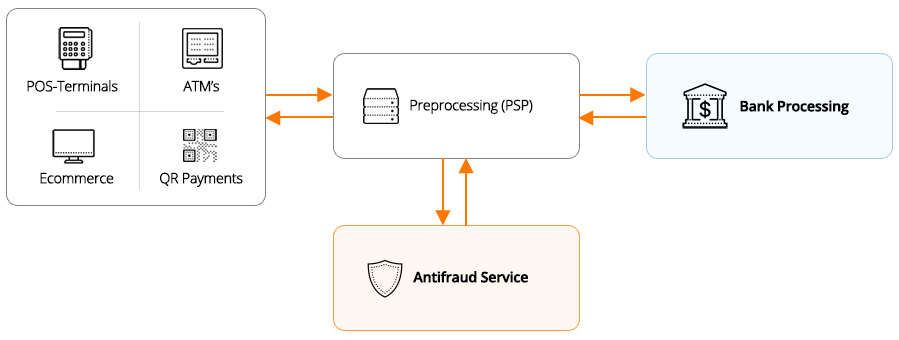

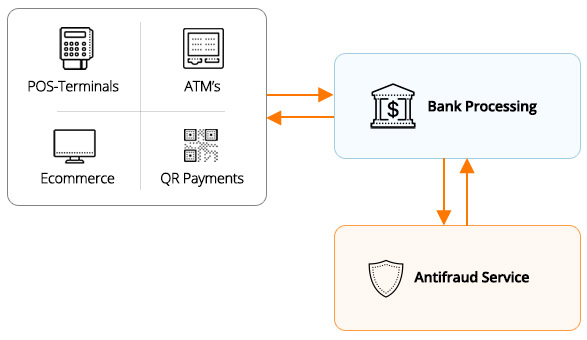

n the on-premise model, the service is installed within the customer’s infrastructure. The Anti-fraud service can operate either through preprocessing or directly within the bank’s processing system.

Option 1: Connection to Preprocessing.

Option 2: Direct connection to Processing.

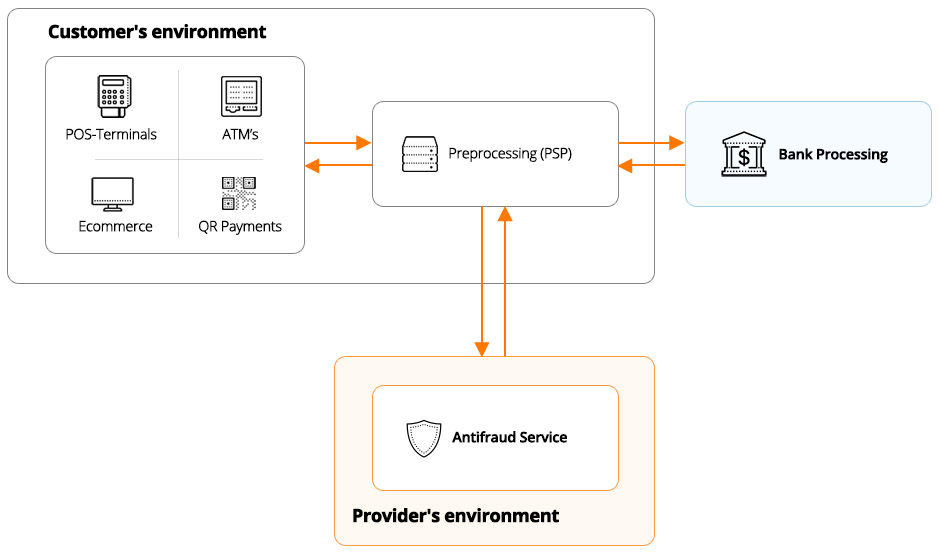

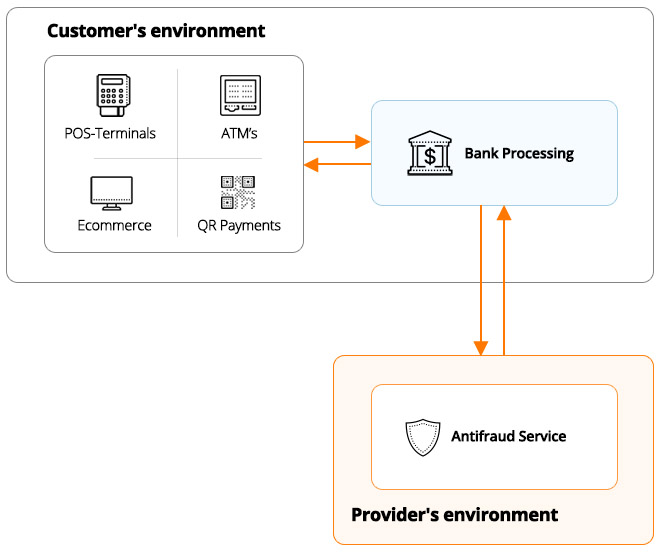

When using the Cloud-based model, the service operates and is maintained on the provider's servers. Integration with the customer's infrastructure occurs through the Anti-fraud Service API. The Anti-fraud service can operate either through Preprocessing or directly in Bank Processing.

Option 1: Connection to Preprocessing.

Option 2: Direct connection to Processing.

The MST Anti-fraud service features a set of predefined rules and allows for the addition of custom rules.

In addition to modifying the existing rule set, new rules can be easily added using the built-in Lua programming language, offering very flexible system configuration.

We customize the service to meet your specific requirements and adapt it to your solution If you're uncertain about task definition, our specialists can help create a well-formulated technical assignment for an anti-fraud system that meets your requests and requirements.

Our system offers flexibility in configuration and operates at high speed, enabling efficient fraud detection

Fill out the application for the anti-fraud system and provide a brief description of your objectives Current status and desired outcome.

Step 1

Application

You're outlining the task and project requirements If necessary, we sign an NDA.

Step 2

Solution

We analyze the tasks, propose a solution, and coordinate the project plan.

Step 3

Contract

We discuss conditions, deadlines, responsible parties, and sign the contract.

Step 4

Implementation

We establish communication methods with the team and commence project implementation.