Acquiring market is constantly changing a lot. If earlier the possibility of accepting Bank Cards at sales outlets was an additional, now it is a necessity.

The growing popularity of non-cash payments via Bank Cards using payment terminals at sales outlets develops infrastructure and makes terminals using more available and comfortable.

Let's consider the following situation

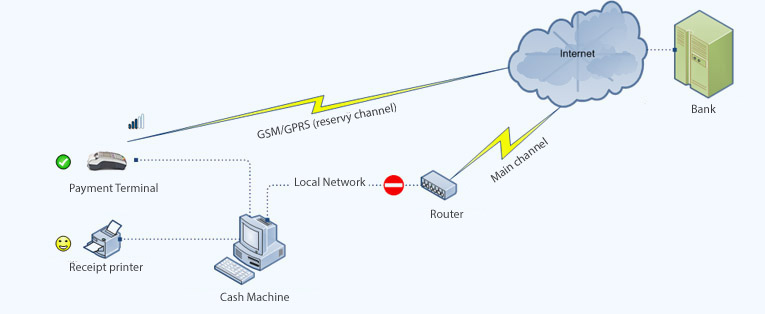

Partner (sales outlet) decides not to reserve the main channel of a company, with an additional operator connected, and also not to provide infrastructure with an additional equipment (For example 3G/4G router).

What to do?

Bank can do as follows:

- Purchase all additional equipment and install it to a partner by itself. In that case, extra accounting of a material issues, inventory write-off and its disposal appears. By the way, that is another point of “failure” in any case.

- Create a reservation via GPRS-channel by an integrated solution using payment terminal (VeriFone VX520 as example).

This technology works as follows: stand-alone terminal VeriFone VX520 that has built-in GPRS module connects to a cash machine. Terminal, in its turn, gets set up as a Pin-Pad. Cash machine literally considers it as a Pin-Pad. Operation goes through a high-speed connection, so that operational time is less than 5-7 seconds. However, if the main channel is not available, it automatically switches you to a built-in GPRS module. In that case, operational time will be about 2 minutes.

What is in conclusion?

We can distinguish the following advantages of this solution:

- High operational speed of work in a regular mode.

- Operation completing is guaranteed even if internet connection is broken.

- No operational mistakes from employees.

- Increasing customer’s loyalty.

- Increasing bank’s commission income.